1. Revenue form

You can add a new revenue by clicking the New tax invoice/New bill button. Adding the form consists of the following fields:

Headline

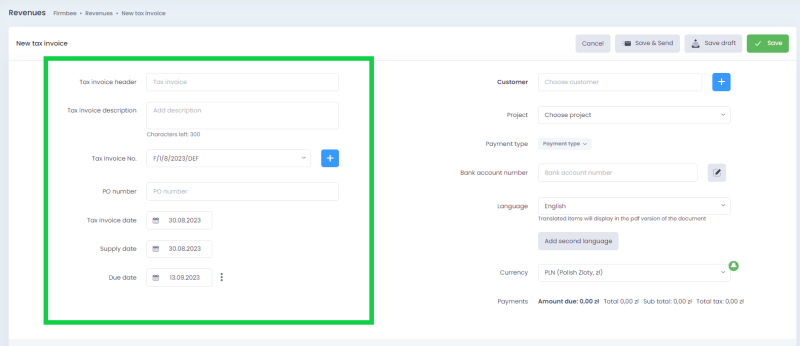

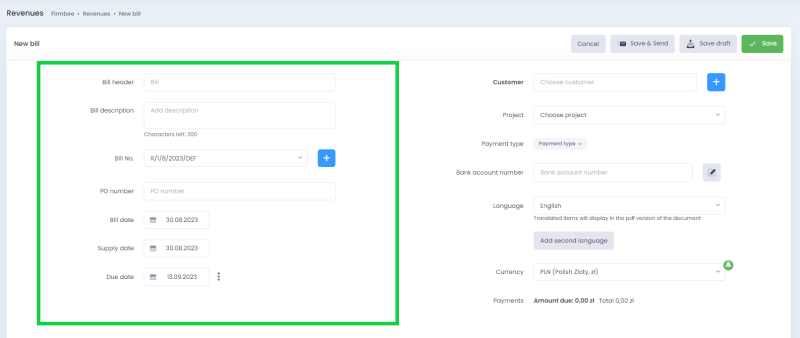

You have to complete the following information:

- header – default headline is named invoice/bill

- description,

- No. – this area is mandatory (read more in configuring the numbering series),

- PO number

- Dates:

- tax invoice date – current date is selected by default. You can change it. This area is mandatory,

- supply date – if it is different from the date of issue. The dates are identical by default,

- due date – the area is filled in by default with the default payment date saved in the account’s settings (if not – date of issue + 2 weeks); there’s also a possibility to select one of the previously chosen payment terms from the list.

Step 1.

Step 2.

New tax invoice

New bill

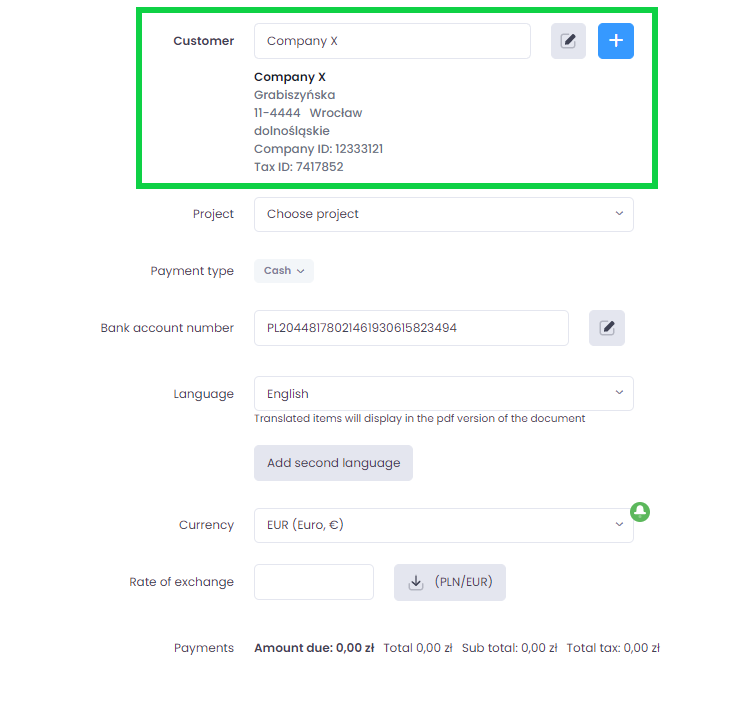

Customer details

You can choose a previously saved contractor from the list or add a new one. In this section, there is a customer selection area and a button which allows you to add a new contractor.

When selected, the following information is displayed:

- contractor name,

- default billing address,

- tax identification number, company’s identification number (if this area was completed).

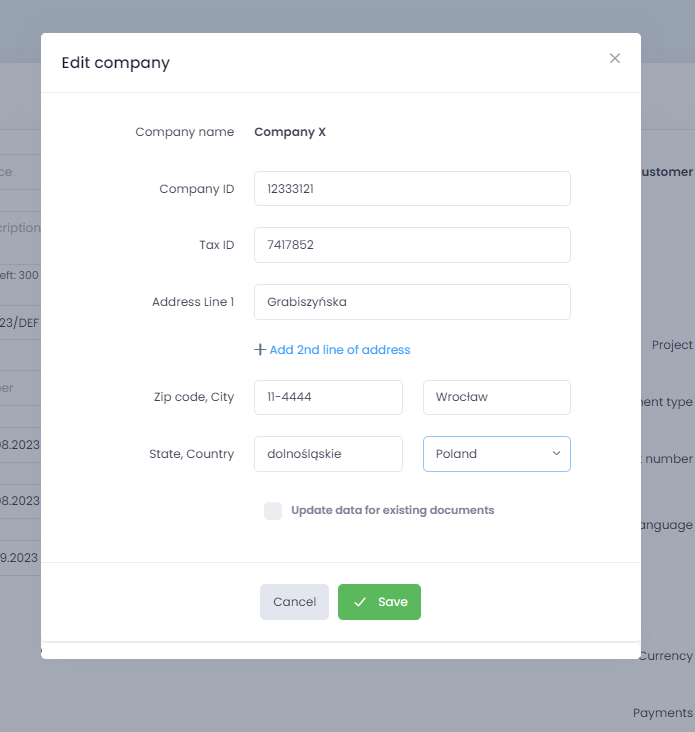

Completed from this level by clicking the Edit button for a given customer. A pop-up window will appear with a possibility to fill in the missing information.

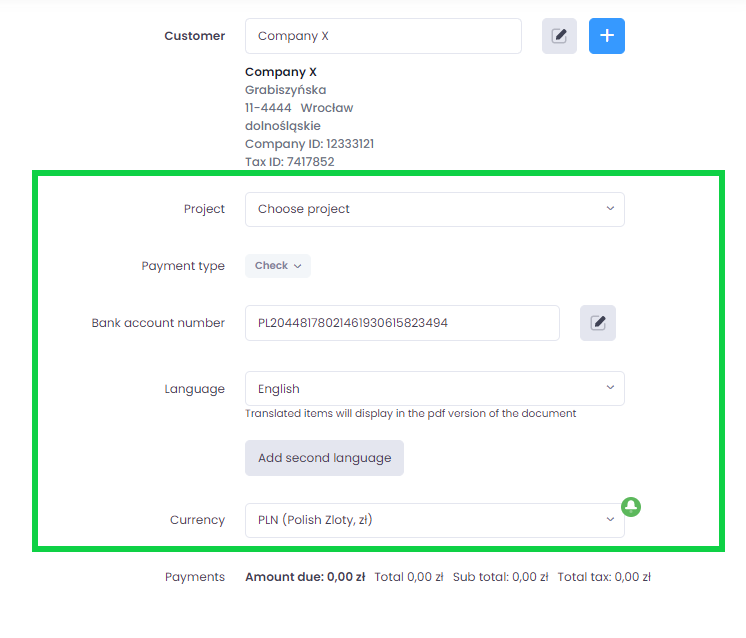

Settings

- Language

- Currency

- Project

- Payment type

- Bank account number

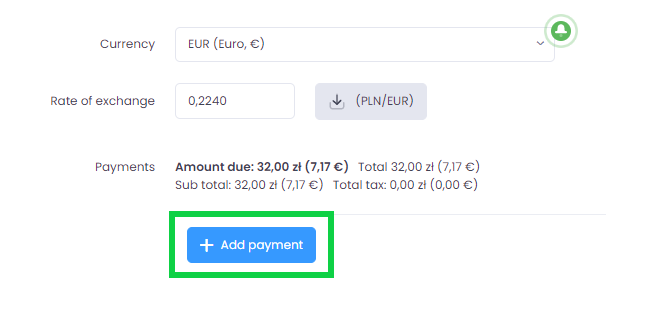

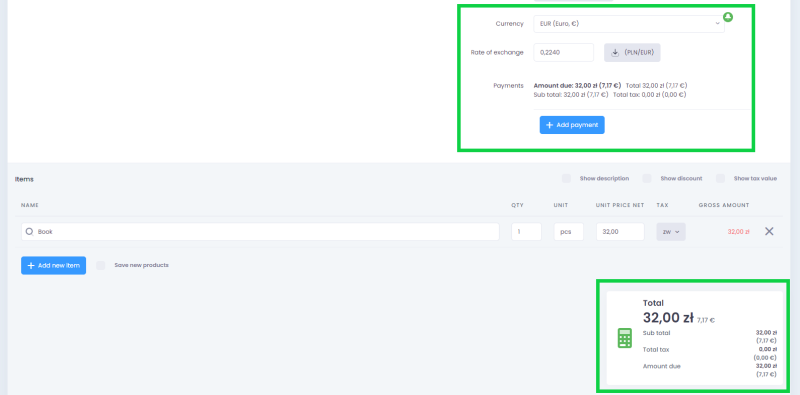

Currency conversion

Revenue items can be converted to a currency other than the account’s main currency. To do this, in the currency selection area pick the currency you want to convert. You can use the automatically downloaded value (the rate according to the European Central Bank) or enter it by yourself. If the system can’t download the currency exchange rate automatically, the download button won’t be displayed.

In the view, the currency for individual items doesn’t change. The values for the main currency and for the converted ones are displayed in the document’s summary.

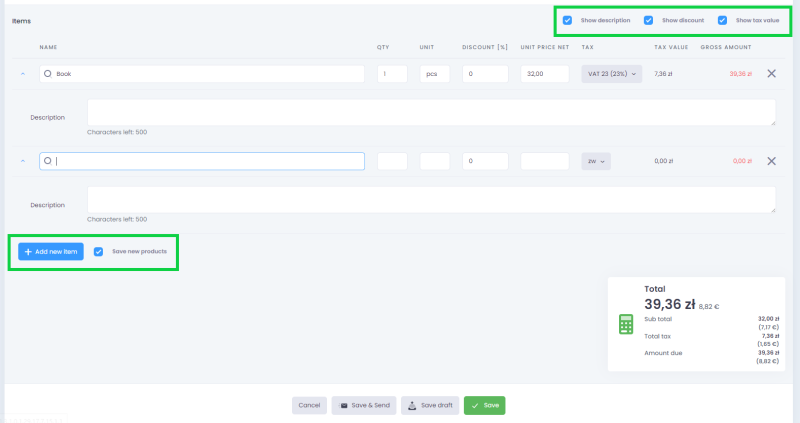

Items

- name of the product/service – you can select already existing or add new one. If you activate checkbox named save new products, the new records will be automatically saved in the Products module,

- quantity,

- unit,

- unit price net,

- tax – you can choose it from the list. If your account doesn’t already have added the tax rate, you have to select it in the configuration (Configuration/Preferences/Sale/Taxes),

- item summary – non-editable amount which is the calculated value for the item which takes into account the quantity, discount and tax.

You can display extra options:

- description,

- percentage discount,

- tax value.

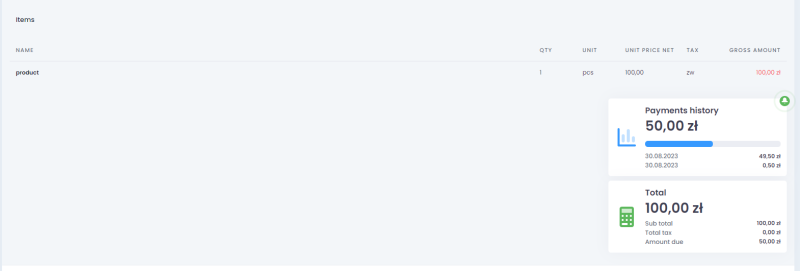

Summary

Below the line you can find a summary of the invoice’s items including:

- gross amount

- net amount

- tax value – the calculated value of each tax used on the invoice. Includes also the tax’s name and indicated rate amount due

Payment history

Contains an area for entering the fee paid by the contractor