Financial services have always relied on data analysis to make informed business decisions in the complex field of banking. It’s no wonder that with the advent of the big data and machine learning era, this sector eagerly embraced new technologies to streamline its processes. Thanks to decisive AI implementations in banking, innovations are already bringing tangible benefits to banks. Let’s examine how artificial intelligence affects the operations of companies successfully employing it in the finance sector. Read on to find out more

AI in banking and finance - table of contents:

AI in banking – introduction

Artificial intelligence is already widely used in many areas of the banking and financial sector. It’s not just chatbots for customer service or well-secured applications. Artificial intelligence is being used in the financial industry for even more serious purposes. Here are the main applications of AI in banking:

- Fraud detection and prevention – advanced algorithms analyze transactions in real time and detect suspicious activity patterns. This effectively protects customers from scams,

- Optimization of financial liquidity forecasting – AI-based predictive models analyze vast amounts of data to precisely predict future cash flows and manage liquidity more accurately.

- Streamlining processes related to creditworthiness assessment – here, too, machine learning algorithms come to the rescue, which, based on the analysis of thousands of credit applications, can accurately assess a customer’s financial credibility,

- Personalization of offers and recommendations for clients – banks utilize advanced recommendation models to tailor financial products to individual customer needs,

- Automation of back-office processes – routine tasks, such as document verification or transaction settlement, can be fully automated with the help of AI.

However, how did companies operating in global markets cope with the implementation of these innovations?

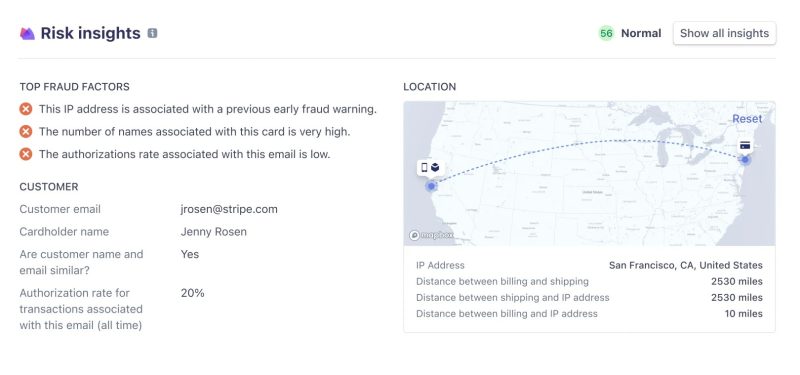

Stripe: transaction credibility through AI in finance

One of the leaders in applying AI to finance is Stripe. It has developed a system called Stripe Radar, which analyzes more than 1,000 features of a transaction in less than 100 milliseconds to assess its reliability. The system has a 99.9% accuracy rate while maintaining a low false alarm rate.

How was this achieved? First, Stripe uses advanced machine learning techniques like deep neural networks. The system is constantly being improved and developed with new capabilities, such as transfer learning.

Second, the company is constantly looking for new signals in transaction data that can help identify anomalies that indicate potential fraud. Stripe’s engineers carefully review each fraud case to understand the criminals’ operating patterns and enrich the system with additional rules.

Stripe Radar is an excellent example of how AI in banking can effectively protect customers from financial scams.

Source: Stripe (https://stripe.com/blog/how-we-built-it-stripe-radar)

Monzo: AI in finance

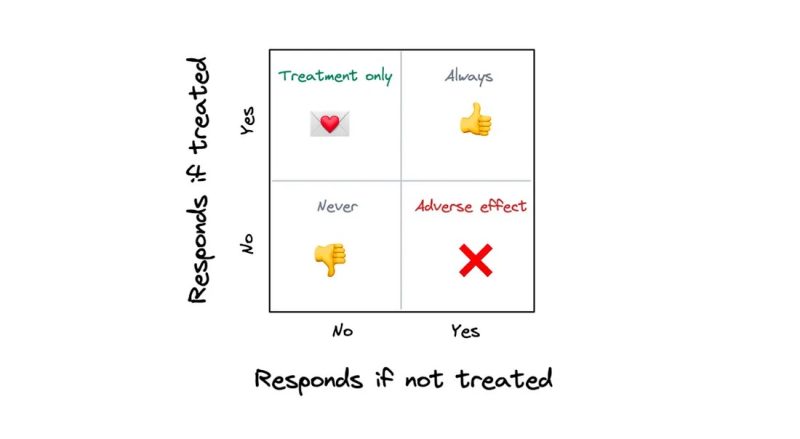

Monzo, a U.K.-based neobank that operates exclusively in the digital space, has applied machine learning capabilities in a completely different area: optimizing marketing campaigns.

The bank has built models that, based on historical data, can estimate the willingness of a given customer to take advantage of an additional offer, such as opening a savings account, if they receive a specific message from the bank.

Next, to maximize the efficiency of the campaign, the system indicates which customers should receive which promotional message. This allows for precisely targeting the message and achieving significantly better results than in the case of mass, non-personalized communication.

In some cases, the implementation of such optimization has allowed Monzo to increase the effectiveness of campaigns by up to 200%! This demonstrates how AI in banking can help reach customers more efficiently with tailored offers that resonate with them.

Source: Monzo (https://medium.com/data-monzo/optimising-marketing-messages-for-monzo-users-3fe805f24572)

Grab: AI in the classification of sensitive data

Grab is a technological giant from Southeast Asia, offering services such as transportation and delivery. The company has decided to leverage the capabilities of Language Models (LLM) to automate the classification process of sensitive data it stores. This is crucial because the company holds the personal and financial data of its customers.

For this purpose, a set of tags has been prepared describing various categories of data, such as:

- Personal data,

- Contact information,

- Identification numbers.

Next, appropriate queries were designed for the language model to automatically assign these tags based on table and column names in the databases.

As a result, Grab can classify stored information by sensitivity much more quickly and cheaply. This makes it easier to enforce data access and privacy policies. According to the company’s estimates, the solution has saved as many as 360 working days per year that were previously spent on manual data classification.

Source: DALL·E 3, prompt: Marta M. Kania (https://www.linkedin.com/in/martamatyldakania/)

Summary. The future of AI in banking and finance

As the examples of Stripe, Monzo, and Grab show, artificial intelligence is already delivering real business value to banks and financial institutions. It can help prevent fraud more effectively, target customers more precisely, or automate tedious tasks.

In the coming years, the role of AI in banking will continue to grow steadily. We can expect the full automation of many back-office processes, hyper-personalization of financial products, and a closer integration of machine learning models with banking systems.

If you like our content, join our busy bees community on Facebook, Twitter, LinkedIn, Instagram, YouTube, Pinterest, TikTok.

Author: Robert Whitney

JavaScript expert and instructor who coaches IT departments. His main goal is to up-level team productivity by teaching others how to effectively cooperate while coding.

AI in business:

- Threats and opportunities of AI in business (part 1)

- Threats and opportunities of AI in business (part 2)

- AI applications in business - overview

- AI-assisted text chatbots

- Business NLP today and tomorrow

- The role of AI in business decision-making

- Scheduling social media posts. How can AI help?

- Automated social media posts

- New services and products operating with AI

- What are the weaknesses of my business idea? A brainstorming session with ChatGPT

- Using ChatGPT in business

- Synthetic actors. Top 3 AI video generators

- 3 useful AI graphic design tools. Generative AI in business

- 3 awesome AI writers you must try out today

- Exploring the power of AI in music creation

- Navigating new business opportunities with ChatGPT-4

- AI tools for the manager

- 6 awesome ChatGTP plugins that will make your life easier

- 3 grafików AI. Generatywna sztuczna inteligencja dla biznesu

- What is the future of AI according to McKinsey Global Institute?

- Artificial intelligence in business - Introduction

- What is NLP, or natural language processing in business

- Automatic document processing

- Google Translate vs DeepL. 5 applications of machine translation for business

- The operation and business applications of voicebots

- Virtual assistant technology, or how to talk to AI?

- What is Business Intelligence?

- Will artificial intelligence replace business analysts?

- How can artificial intelligence help with BPM?

- AI and social media – what do they say about us?

- Artificial intelligence in content management

- Creative AI of today and tomorrow

- Multimodal AI and its applications in business

- New interactions. How is AI changing the way we operate devices?

- RPA and APIs in a digital company

- The future job market and upcoming professions

- AI in EdTech. 3 examples of companies that used the potential of artificial intelligence

- Artificial intelligence and the environment. 3 AI solutions to help you build a sustainable business

- AI content detectors. Are they worth it?

- ChatGPT vs Bard vs Bing. Which AI chatbot is leading the race?

- Is chatbot AI a competitor to Google search?

- Effective ChatGPT Prompts for HR and Recruitment

- Prompt engineering. What does a prompt engineer do?

- AI Mockup generator. Top 4 tools

- AI and what else? Top technology trends for business in 2024

- AI and business ethics. Why you should invest in ethical solutions

- Meta AI. What should you know about Facebook and Instagram's AI-supported features?

- AI regulation. What do you need to know as an entrepreneur?

- 5 new uses of AI in business

- AI products and projects - how are they different from others?

- AI-assisted process automation. Where to start?

- How do you match an AI solution to a business problem?

- AI as an expert on your team

- AI team vs. division of roles

- How to choose a career field in AI?

- Is it always worth it to add artificial intelligence to the product development process?

- AI in HR: How recruitment automation affects HR and team development

- 6 most interesting AI tools in 2023

- 6 biggest business mishaps caused by AI

- What is the company's AI maturity analysis?

- AI for B2B personalization

- ChatGPT use cases. 18 examples of how to improve your business with ChatGPT in 2024

- Microlearning. A quick way to get new skills

- The most interesting AI implementations in companies in 2024

- What do artificial intelligence specialists do?

- What challenges does the AI project bring?

- Top 8 AI tools for business in 2024

- AI in CRM. What does AI change in CRM tools?

- The UE AI Act. How does Europe regulate the use of artificial intelligence

- Sora. How will realistic videos from OpenAI change business?

- Top 7 AI website builders

- No-code tools and AI innovations

- How much does using AI increase the productivity of your team?

- How to use ChatGTP for market research?

- How to broaden the reach of your AI marketing campaign?

- "We are all developers". How can citizen developers help your company?

- AI in transportation and logistics

- What business pain points can AI fix?

- Artificial intelligence in the media

- AI in banking and finance. Stripe, Monzo, and Grab

- AI in the travel industry

- How AI is fostering the birth of new technologies

- The revolution of AI in social media

- AI in e-commerce. Overview of global leaders

- Top 4 AI image creation tools

- Top 5 AI tools for data analysis

- AI strategy in your company - how to build it?

- Best AI courses – 6 awesome recommendations

- Optimizing social media listening with AI tools

- IoT + AI, or how to reduce energy costs in a company

- AI in logistics. 5 best tools

- GPT Store – an overview of the most interesting GPTs for business

- LLM, GPT, RAG... What do AI acronyms mean?

- AI robots – the future or present of business?

- What is the cost of implementing AI in a company?

- How can AI help in a freelancer’s career?

- Automating work and increasing productivity. A guide to AI for freelancers

- AI for startups – best tools

- Building a website with AI

- OpenAI, Midjourney, Anthropic, Hugging Face. Who is who in the world of AI?

- Eleven Labs and what else? The most promising AI startups

- Synthetic data and its importance for the development of your business

- Top AI search engines. Where to look for AI tools?

- Video AI. The latest AI video generators

- AI for managers. How AI can make your job easier

- What’s new in Google Gemini? Everything you need to know

- AI in Poland. Companies, meetings, and conferences

- AI calendar. How to optimize your time in a company?

- AI and the future of work. How to prepare your business for change?

- AI voice cloning for business. How to create personalized voice messages with AI?

- Fact-checking and AI hallucinations

- AI in recruitment – developing recruitment materials step-by-step

- Midjourney v6. Innovations in AI image generation

- AI in SMEs. How can SMEs compete with giants using AI?

- How is AI changing influencer marketing?

- Is AI really a threat to developers? Devin and Microsoft AutoDev

- AI chatbots for e-commerce. Case studies

- Best AI chatbots for ecommerce. Platforms

- How to stay on top of what's going on in the AI world?

- Taming AI. How to take the first steps to apply AI in your business?

- Perplexity, Bing Copilot, or You.com? Comparing AI search engines

- ReALM. A groundbreaking language model from Apple?

- AI experts in Poland

- Google Genie — a generative AI model that creates fully interactive worlds from images

- Automation or augmentation? Two approaches to AI in a company

- LLMOps, or how to effectively manage language models in an organization

- AI video generation. New horizons in video content production for businesses

- Best AI transcription tools. How to transform long recordings into concise summaries?

- Sentiment analysis with AI. How does it help drive change in business?

- The role of AI in content moderation