Maintaining the financial health of a startup is one of the biggest challenges, especially in its early stages of development. Startup owners must demonstrate great skills to manage cash flow and avoid illiquidity. In this article, we explain such terms as cash flow, burn rate, and startup runway, all of which are important in financial management for startups. Read on.

Financial management for startups – table of contents:

- Financial management for startups

- Cash flow

- Financial forecasting

- Burn rate

- Startup runway

- Check out our software for financial & invoice management

Financial management for startups

Many startups fail as they run out of money, the product or service is still at the implementation stage, and no investors have been attracted. This is a very difficult situation that should be avoided at all costs. It is possible thanks to wise financial management, which has a significant impact on the success of the entire venture. Monitoring cash flow and financial forecasting will help you keep everything under control.

Cash flow

Let’s turn our attention to cash flow, or the cash flow statement. This is a key element in planning and managing a startup, allowing you to effectively take care of its financial liquidity. It shows the company’s sources of financing and the use of funds.

Thanks to the cash flow statement, it is easy to determine how much money is at your disposal, what sources it comes from, and how it has been managed. Cash flow is monitored and forecasted in different time perspectives – short-term (up to 90 days), medium-term (up to 2 years), and long-term (up to 5 years).

Why is cash flow analysis so important for companies? First of all, it increases the financial security of an organization. You can get in-depth information about the company’s need for funds, including external ones.

Cash flow analysis allows you to assess the financial health of the startup, shows the flow of funds in the organization, and ultimately determines its solvency. It is worth mentioning that cash flow analysis is also eagerly used by banks and investors wishing to assess a startup’s financial credibility.

Financial forecasting

Financial forecasting is a projection of future operating results, taking into account investments and other sources of financing. Of course, it is important to be aware that this is only an estimate made on the basis of currently available data. Therefore, it is necessary to update such forecasts from time to time. Only then can you effectively manage your startup’s finances.

Burn rate

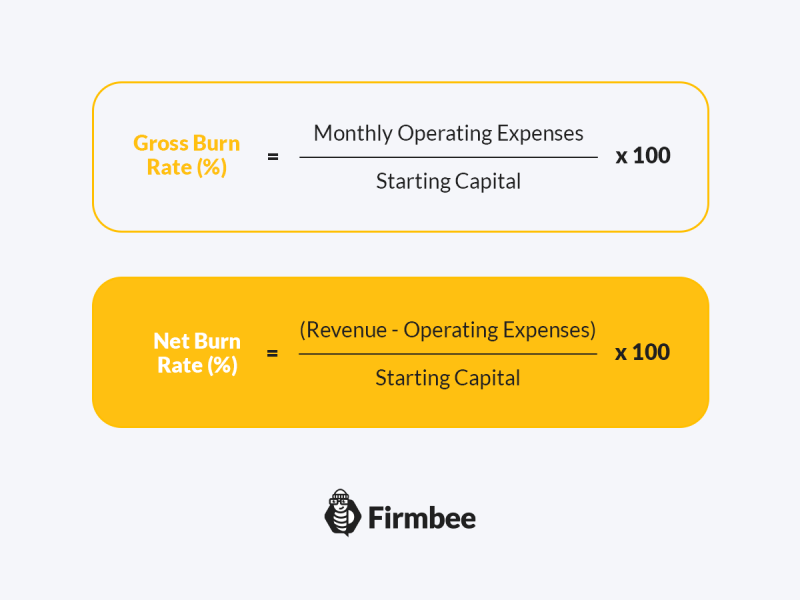

Another metric that is important for good financial management is the so-called burn rate. This metric shows how quickly a startup spends money when positive cash flow from the company’s operations has not yet been generated, that is before it becomes profitable. The burn rate is usually reported on a monthly basis. This metric is used by startups, but is also readily analyzed by investors who can track the amount of money spent by the startup.

Startup runway

Startup runway simply defines how many months a startup can operate before it runs out of money. This metric is crucial for budgeting, but also for strategy preparation, financial forecasting, and raising funds from external sources.

Thanks to a startup runway, you can analyze how quickly you are spending funds and assess when it will be necessary to raise capital or adjust the business model to new conditions. How do you calculate a startup runway? You can calculate the runway by taking your beginning cash balance and dividing it by your net burn rate.

Efficient financial management is important not only for a startup but also for any other company. Constant monitoring of such metrics as cash flow, burn rate, and startup runway not only shows the financial health of the organization, but also allows you to react early enough to avoid losing liquidity.

Check out our software for financial & invoice management:

If you like our content, join our busy bees community on Facebook, Twitter, LinkedIn, Instagram, YouTube, Pinterest.

Author: Andy Nichols

A problem solver with 5 different degrees and endless reserves of motivation. This makes him a perfect Business Owner & Manager. When searching for employees and partners, openness and curiosity of the world are qualities he values the most.

Launch your startup:

- What is a startup?

- Pros and cons of creating a startup

- 8 best industries for startups

- Top 5 skills every highly successful startup founder needs

- How to create a startup? 7 simple and easy steps

- 6 essential startup development stages

- How to create a startup growth strategy?

- General startup statistics you need to know

- Startup vs. corporate job. Which is right for you?

- 5 incredible companies that started in a garage

- How to find a business idea?

- How to check if your startup idea already exists?

- How to name a startup? Useful tips and strategies

- How to gain business knowledge quickly? 5 best practices

- Why do startups fail? 6 startup ideas you should avoid

- 5 weird business ideas that made millions

- Top 6 most profitable small businesses

- 7 questions to determine if your business idea is worth pursuing

- What is a buyer persona? 5 benefits of creating a buyer persona

- How to validate your business idea? 3 easy steps

- Should you follow your passion? The importance of passion in business

- What is market reseach and why is it important?

- Using social media in business

- What to do when you have too many business ideas?

- How to write a good problem statement for your startup?

- How to test your business idea for real?

- How to create a prototype for a product?

- How to build an MVP?

- How to use surveys for testing your business idea?

- 10 useful tools to validate your business idea

- What is a business plan? 4 types of business plans

- What should be included in a business plan?

- What should a product description include?

- Competitor analysis

- Marketing strategy

- Traditional business plan vs. lean startup plan

- Implementation plan. What is it and how to create it?

- Everything you need to know about patents

- Financial management for startups

- What permits and licenses does my startup need?

- What is the average startup founder salary?

- 4 startup taxes you need to pay

- Which legal structure is best for your business?

- Startup costs. How much money will you need?

- Protection of intellectual property in a startup

- Family funding vs. self-funding

- What is a shareholders’ agreement?

- What should a financial section of a business plan include?