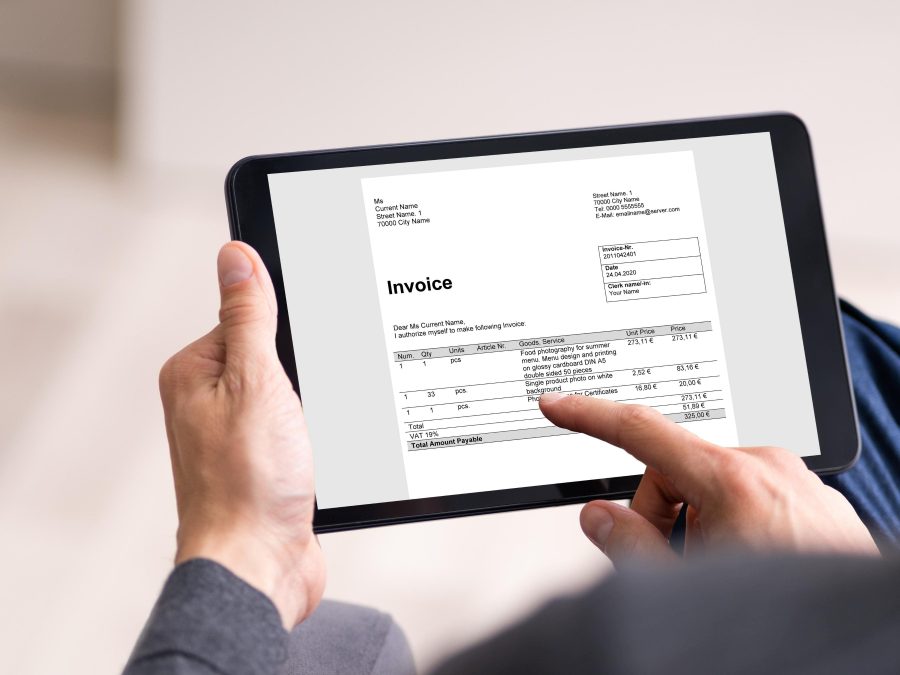

Anyone who sets up a business, sooner or later will have to issue invoices for sold goods and services. What should an invoice include? Since it is an official document, its content is strictly regulated by law. Using tips provided here, you will certainly cope with issuing invoices correctly.

What should an invoice include? – table of contents:

- The word INVOICE

- Unique invoice number

- Seller’s name and address

- Buyer’s name and address

- Invoice issue date

- Supply date

- Description of products and services rendered

- Price and quantity for each product or service rendered

- Total amount due

- Due date

- Payment methods

- Applicable taxes

The word INVOICE

What should an invoice include? If you want to issue an invoice, then the word “invoice” must appear on it. This tells you that it is an official document that confirms the sale of goods or services. This word distinguishes the invoice from other documents used in companies, such as a warehouse release form or commercial offer, which may also contain some elements that are typical of invoices.

Unique invoice number

Each invoice should have its own unique number. The numbers ought to be assigned sequentially and there should be no sequence breaks. To make it easier, you can use various series of invoice numbers. This is useful especially in large companies. Each series can have its own numbering and apply to sales from different warehouses and trading platforms.Thanks to grouping your invoices, you will find it easier to identify your company’s revenue streams.

Seller’s name and address

On the invoice you need to provide details that will identify you as the seller. Depending on the type of business, this could be your name or the full name of your company. Here you also include your business mailing address and tax identification number.

Buyer’s name and address

The invoice must clearly identify to whom you sold your goods or services. In this place, you put a similar set of data as in the case of your company. If the buyer is a private person, you don’t usually need to issue the invoice. However, you might have to create such a document at the buyer’s request. In such a case, it will be enough to enter the buyer’s name and surname in the space intended for the buyer’s data.

Invoice issue date

You’ve got a specific amount of time to issue the invoice. How do you know when to issue it? This is determined by tax regulations. Since invoices are used, among others, to calculate taxes due, you can’t wait too long to issue them. Why? Invoices issued after the deadline may be considered as deliberate tax avoidance. If you don’t want to miss it, ask your accountant or use a tool that will let you know how much time you have to issue your invoice.

Supply date

What should an invoice include? You must also specify the supply date of goods or services on your invoice. This is often a specific date, but for some services it may be the month when the service was provided. If you charge your customers in advance, the supply date can refer to the scheduled delivery date of goods or services and be placed in the future.

Description of products and services rendered

Invoices must accurately describe what you sold. This applies to both goods and services. In the case of goods, it is a bit easier as you can provide, for example, EAN (European Article Number) or GTIN (Global Trade Item Number) number. When selling services, you should also specify what the service is about, so that there is no doubt that you provided it.

Price and quantity for each product or service rendered

Your invoice must contain the price and quantity for each product or service rendered. If the customer bought more than one item of goods or services, you should specify their value. How to do it? Just multiply the number of purchased pieces by their price.

Total amount due

This is undoubtedly one of your favourite elements on the invoice. It determines how much money you will get for sold goods and services. Keep in mind that this must be an accurate summary of the prices for each item. There is no room for a mistake here. A wrongly entered total amount will require a correction, which will probably delay the buyer’s payment.

Due date

This is where you set the date by which your customer must pay for the goods and services they purchased. Thanks to it, you know when you can expect the payment. Obviously, it may happen that your contractor pays much earlier. However, customers sometimes fail to meet the agreed payment deadlines. As the invoice is a legal document, by setting the due date, you can take legal steps that will allow you to get the payment due.

Payment methods

What should an invoice include? When issuing invoices, you also need to indicate what payment methods you accept. There are a variety of popular payment methods available to business owners: cash, cash on delivery, bank transfers, PayPal etc.

Applicable taxes

If VAT is applicable in the country where you run your business, then VAT rates and amounts must be included on the invoice. However, there are some exceptions since some businesses are exempt from paying VAT. In such a case, you don’t have to worry about tax rates. The situation may look different if you sell goods and services abroad. Then, even if your business is registered in the country where VAT is not applicable or you are exempt from VAT, you may still have to charge VAT on foreign transactions.

Create invoices with our free invoicing app and billing software. Check it here!

If you like our content, join our busy bees community on Facebook and Twitter.

Author: Andy Nichols

A problem solver with 5 different degrees and endless reserves of motivation. This makes him a perfect Business Owner & Manager. When searching for employees and partners, openness and curiosity of the world are qualities he values the most.