Reconciliation of invoices is a process consisting in the comparison of the data from the invoices with the data from bank statements. It is very important task for all the companies. Reconciliation of the invoices applies both to invoices for purchased goods and services and invoices issued to clients. Thanks to this operation you can check if your are late with your payments for business-related purchases. This will allow you to control receivables better. Read the article to find out why the reconciliation of invoices should not be neglected.

Reconciliation of invoices – the content of the article:

- How to reconcile the incoming invoices?

- What are the benefits of reconciliation of incoming invoices?

- How to reconcile outgoing invoices?

- What are the benefits of reconciliation of outgoing invoices?

- Is it possible to reconcile invoices manually?

- How to improve the process of reconciliation of invoices?

How to reconcile the incoming invoices?

Every time when you purchase goods you receive an invoice. Similarly with the services – those are settled with invoices as well. If your company just recently appeared on the market there is a risk that not all partners will be eager to sell their products or services based on deferred payment. In such scenario, you will have to settle your payments in cash. This method of payment means that you won’t have to reconcile incoming invoices. In case of cash invoices you always can stay rest assured that it has been settled.

After some time, when your company become better known by the contractors, more and more companies will be eager to sell their products to you on the basis of deferred payment. It is beneficial, because purchasing products you don’t have to invest your funds on the spot. Your only task is to keep an eye on the payment deadlines. Reconciliation of invoices helps with this important endeavor. How to reconcile invoices?

All you have to do is to compare incoming invoices, namely those you have received from other companies, with your bank account. To speed up the process you may decide to filter incoming invoices. After this operation you will get the full list of transactions with all the details about the payments made for products and services. With such list in hand you will have to compare figures on the invoices with those on the bank statements. Check if all the transferred money has reached the right recipient by comparing invoice issuer details with the details of the invoice recipient. If those details match and everything is correct, you can tick off the invoice as paid.

What are the benefits of reconciliation of incoming invoices?

Why reconciliation of incoming invoices in your company is so important? This operation helps you to keep control over all payment dates and deadlines. If after the reconciliation you still have any invoices but there are no matching transfers it means only one thing – you have not paid those invoices. In this situation you have to check if the payment deadline was exceeded. If some of the transfers have not been done, check your account in the pending orders section, they may be awaiting the realization, in this case there is nothing to be alarmed about. However, if the payment deadline was exceeded and the invoice has not been paid, it is better to settle all outstanding payments as soon as possible.

Payment made after the deadline may have negative consequences for your business. What kind of consequences? The issuer of the invoice that hasn’t been paid on time may charge you an interest for deferral of the payment. Late payment may result in losing discounts and rebates. Problems with payments affect the image of your company, because nobody likes to cooperate with entities that are often late with payments. Reconciliation of invoices helps your to avoid such problems, with this process you will be able to discharge your obligations on time.

How to reconcile outgoing invoices?

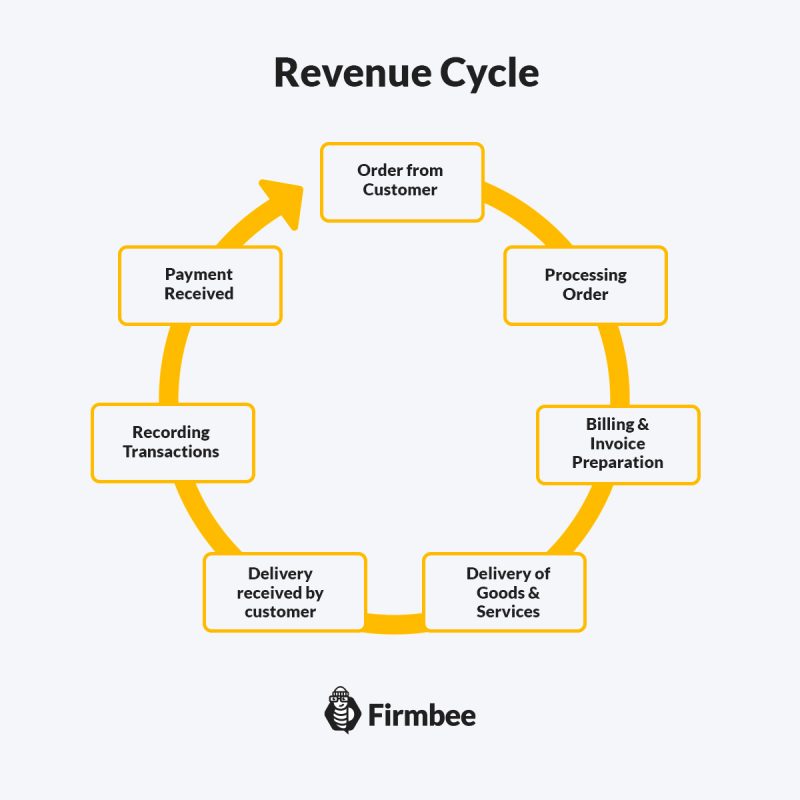

Outgoing invoices are invoices sent by your business to your clients when your product has been sold or your service has been provided. Reconciliation of outgoing invoices will help you to keep an eye on all your liabilities. Thanks to this operation you will know exactly, who paid you, and who is in delay of payment. How in reality reconciliation of outgoing invoices is made?

The details from bank statements have to be cross-referenced with all issued outgoing invoices. To speed up the process you may decide to filter outgoing invoices. After this operation, you will get the full list of payments to the account. In the next step you have to compare all the numbers from the bank statement with the outgoing invoices. Check thoroughly if the details of the person or details of the company that has paid the invoice correspond with the details of the buyer on the outgoing invoice.

Special caution is advised during invoice reconciliation especially if there were several invoices with the same amount to be paid, but for different customers. Lack of accuracy during reconciliation may result in matching the invoice with the wrong client. To avoid such mistakes check all the titles of the transfers. As long as you know for what product or service the payment has been made it should be easy to match the transfer with the right outgoing invoice. But why reconciliation of invoices is so important?

What are the benefits of reconciliation of outgoing invoices?

Reconciliation of outgoing invoices gives you an insight into the current financial situation of the company. Thanks to reconciliation you know which invoices issued by you have been already paid, and you know what kind of income you may expect in your account in the near future. The operation of reconciliation will help you to notice all the customers, who are behind with payments for your products or services. With the exact information you may decide to take action in this area and force your debtors to settle your claims. Don’t hesitate with sending your clients gentle reminders about their payment, any delay in doing so may result in problems with recovery of your receivables. Do not neglect outgoing invoices reconciliation.

Is it possible to reconcile invoices manually?

If you don’t issue many invoices the process of reconciliation will not take much of your time. Similarly, if you have not issued many cost invoices the check-up of ingoing invoices should not be difficult. With small amount of documents all reconciliation of invoices may be done manually. It is handy to create a list of all ingoing invoices, where you can tick off all those already paid, and see the rest, that still are waiting to be settled. You should create the same type of list for all outgoing invoices. On this list you tick off all the invoiced paid by your clients to see those, who are in delay of payment.

While reconciling invoices to speed up the process it is wise to use well-prepared spreadsheet. It is worth to put all the invoices in chronological order.

Regular reconciliation of invoices is a good practice.

Try to mark all incoming paid invoices immediately upon receipt of the transfer to your account. Reconciliation of invoices manually may not be the best option for those who have many invoices. What to do to facilitate the operation of invoices reconciliation when there is much more documents to check. How to deal with reconciliation that cannot be done manually?

How to improve the process of reconciliation of invoices?

To facilitate the process of reconciliation of invoices that cannot be done manually it is beneficial to use special software. The dedicated application will help you to find all the discrepancies between outgoing invoices and transfers on your account. With the application, you can easily determine if your client has paid the invoice in full, partly or is behind with payment. Computer software allows you to find quickly all invoices with expired deadlines, which may enable you to collect debts if needed. You will never miss the payment date for the purchased products and services. The application will help you to save much time, which can be used in other areas of your activity.

Read also: What is invoice discounting?

Thanks to automations, your business can reduce the costs of invoicing by 29%. Check our free invoicing app and billing software.

If you like our content, join our busy bees community on Facebook, Twitter, LinkedIn, Instagram, YouTube, Pinterest.

Author: Andy Nichols

A problem solver with 5 different degrees and endless reserves of motivation. This makes him a perfect Business Owner & Manager. When searching for employees and partners, openness and curiosity of the world are qualities he values the most.