It can take a long time for an invoice to turn from an agreement to money on the account. What can you do to get paid faster? Try invoice discounting to find out as today we’ll take a closer look at this solution with its ins and out.

Invoice discounting – table of content:

- What is invoice discounting?

- How does discounting of invoices affect financial liquidity?

- What is the difference between invoice discounting and factoring?

- Can I discount overdue invoices?

- What are the advantages of invoice discounting?

What is invoice discounting?

Invoice discounting involves taking out a loan against invoices issued by you with deferred payment dates. Depending on the risk assessment of the discounting agent you may receive from 70 to 95% of the amount shown on your invoices. The dealer will charge you for its services. These may include a flat monthly fee and a small percentage of the financing provided. However, you must remember that you are responsible for collecting the receivables.

Companies with a stable financial situation get to receive the offer of invoice discounting. Upon initial acceptance, the invoice discounter may ask to see your account statement. Additionally usually every month, you will need to send a report of your accounts receivable to the discounting company so they can calculate how much they can lend you. What are the benefits of invoice discounting?

How does discounting of invoices affect financial liquidity?

Invoice discounting is a great way to provide your company with working capital. You can use the funds received to purchase goods necessary for your business without waiting for money to come in from customers. The ability to trade such funds sooner should translate into higher profits.

There are indeed some words of wisdom in the saying “It takes money to make money”. Sometimes you may come across companies that give discounts when you buy with cash. With the extra cash coming from invoice discounting, you have many options that can tangibly benefit you.

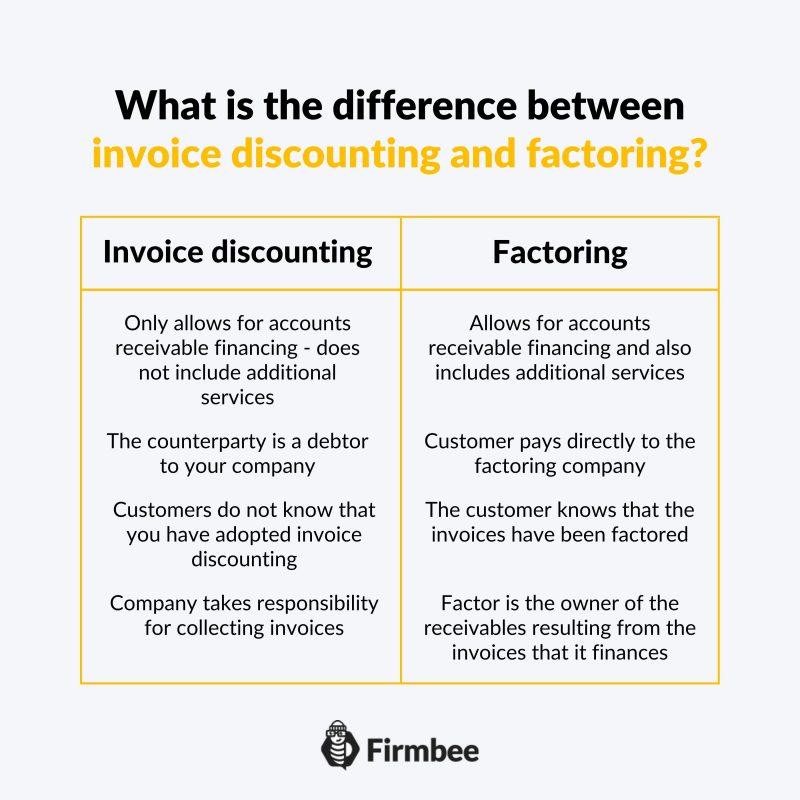

What is the difference between invoice discounting and factoring?

At the first glance, it seems that invoice discounting and factoring are the same thing. But look more closely and you’ll find how they differ. Although factoring, like invoice discounting, allows you to finance your receivables, it also includes additional services. These include maintaining debtor accounts and related reporting, collecting receivables as well as, and assuming the risk of counterparty insolvency.

With invoice discounting, your counterparty still owes your company for the invoices you issue. You’ll receive money from the discounter though your customers won’t know that you adopted the method of financing. The onus is on you to enforce full payment of your invoices. This may involve reminding the payers of upcoming payment deadlines, monitoring receivables, and even sending out calls for payment in case of delays. Since invoice discounting is a type of loan, you need to ensure that your contractors pay the money for the invoices you’ve issued. Why is this important? If they don’t pay you by the due date, you won’t have any money to pay back the loan granted by the factor.

Full factoring s different. It is the factoring company, also known as the factor, that becomes the owner of the receivables resulting from your invoices. Your counterparties have to get notified that you have employed this method of financing your business. You may be wondering what is this knowledge for? The reason is simple. Your customers will have to pay for the invoices financed by the factoring company, not to your company, but to the factoring company. Therefore, you have to inform them about it.

Even if someone made a payment to your account by mistake, if you follow factoring to finance your invoices, you will have to transfer the entire payment to the factoring company. This is because the factor is the owner of the receivables resulting from the invoices that it finances. Of course, it does not do this for free. You will receive about 80 to 90% of the value of the receivables arising from the invoices you have issued. In this case, you don’t have to worry about collecting the receivables from your counterparties. That task passes to the factoring company.

Can I discount overdue invoices?

The invoices you intend to discount are actually collateral for a loan that the discounting company makes. Therefore, the discounting company assesses how likely it is that your counterparties will settle their obligations to you. If a customer has not paid for a purchased good or service by the due date indicated on the invoice, the likelihood of them paying decreases with each passing day. Of course, non-payment can happen as a result of a mistake or an oversight, no one is flawless.

However, in most such cases, debt collection activities will have to take place to recover overdue debts. These require time and effort and may not always prove successful. That’s why past due invoices are usually not taken into account when calculating how much of a collateral loan an invoice discounting company can provide.

What are the advantages of invoice discounting?

The advantage is faster cash flow. The money owed to you for invoices will reach you practically immediately after concluding the contract with the invoice discounting company. This means you can turn these funds around much sooner and use them to grow your business. Of course, this type of financing comes with strings attached.

Still, there are ways to convince customers to pay early. For instance, by giving a discount for early payment of dues. However, it’s not worth doing this for invoices for which you’re going to get financing through an invoice discounting company anyway. Why? Because you will incur a double cost in doing so. First, the discounting and second the fee the invoice discounting company will charge.

Therefore, a practical hint is to group your customers according to how quickly they pay your invoices. If they pay you long before the due date, it’s not worth discounting, because you’ll get the money you owe at no extra charge. On the other hand, if they delay payment until the last day, and you need additional financing for your business, then discounting such invoices is a good option to go for.

Are you looking for the perfect free invoicing app? You can find it at Firmbee!

If you like our content, join our busy bees community on Facebook, Twitter, LinkedIn, Instagram, YouTube.

Author: Andy Nichols

A problem solver with 5 different degrees and endless reserves of motivation. This makes him a perfect Business Owner & Manager. When searching for employees and partners, openness and curiosity of the world are qualities he values the most.