As a business owner or manager, you know that making informed decisions is essential to your company’s success. One powerful tool that can help you gain insight into your company’s financial health is a ratio analysis. By analyzing financial ratios, you can compare your company’s performance over time, identify its strengths and weaknesses, and make wiser decisions about your business strategy. In this blog post, we’ll take a closer look at what a ratio analysis is, how it works, and how you can use it to drive your business forward. Read on.

What is a ratio analysis? – table of contents:

- What is a financial assessment of a company?

- What is a ratio analysis?

- Types of financial ratios

- How to conduct a ratio analysis?

- Summary

What is a financial assessment of a company?

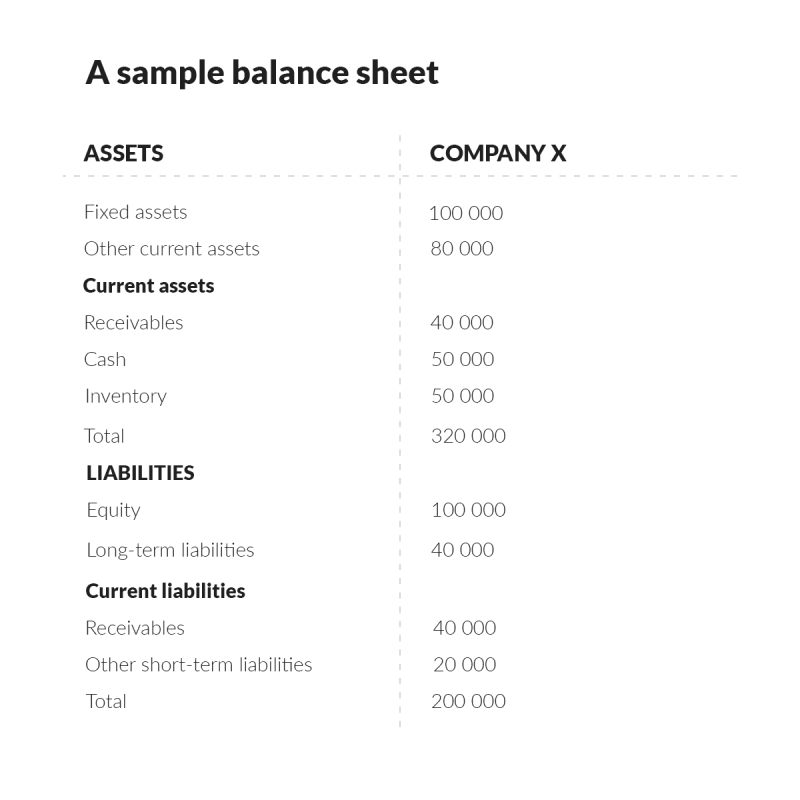

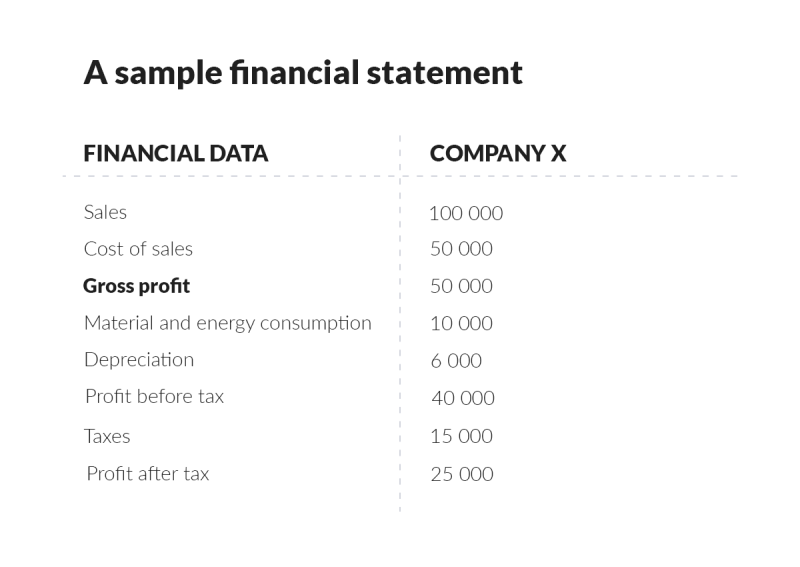

A financial assessment of a company is about analyzing its performance, funds allocated to achieve certain goals, capital, turnover and losses. It’s usually carried out to detect any irregularities related to a company’s finances and make the necessary changes for further development. You can get the most relevant data from the balance sheet, income statement and cash flow statement.

What is a ratio analysis?

A ratio analysis is one of the methods of analyzing a company’s financial performance. It lets you obtain data on liquidity, debt, profitability and many other areas relating to running a business. It involves comparing financial data from company reports, which can usually be found in online records.

Types of financial ratios

There are several types of financial ratios used in a ratio analysis, for example, static, dynamic, relative, and absolute ratios. Static ratios use information from the income statement and the balance sheet, while dynamic ratios use the information from the cash flow statement. Absolute ratios relate to the financial resources of the company. On this basis, relative ratios are calculated, whose value is the quotient of absolute ratios.

Financial ratios can be grouped depending on the area of the company’s performance we want to analyze. For example, to evaluate a company’s profitability, we can look at ratios like return on investment or return on equity. To assess its solvency, we can examine liquidity ratios and debt ratios.

Debt

To get an idea of a company’s debts and its ability to pay them off, you should look at, for example:

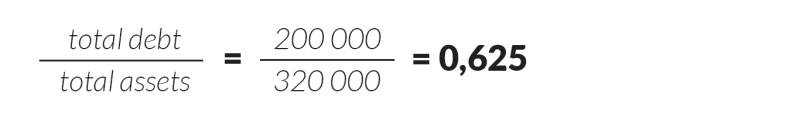

- Debt to assets ratio that shows how much of a company’s assets are financed by debt. It is calculated by dividing the total amount of debt a company owes by the total value of its assets.

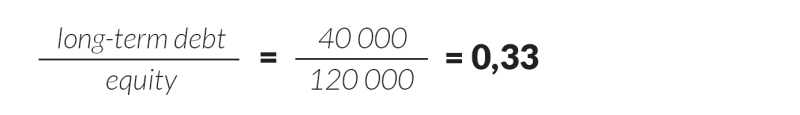

- Long-term debt to equity ratio that measures the amount of long-term debt a company has in relation to its equity.

Liquidity

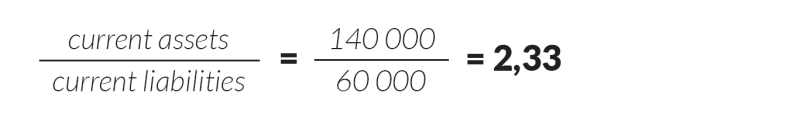

To examine a company’s liquidity, you need to know the value of the current ratio that can be calculated by dividing a company’s current assets by its current liabilities.

Profitability

To check a company’s profitability, it is necessary to pay attention to sales results, profits and the way it uses its own capital. To this end, it’s useful to take a closer look at the following ratios:

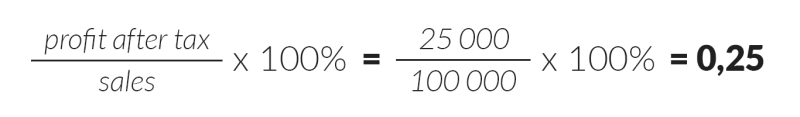

- Return on sales (ROS) – it is calculated by dividing a company’s income by its net sales revenue.

- Return on equity (ROE) – it shows how much profit a company generates in relation to the amount of money invested by shareholders.

- Return on assets (ROA) – it measures how effectively a company uses its assets to generate profits.

Market efficiency

Market efficiency indicators allow you to assess how efficiently a company operates in its business environment. These are, for instance:

- Days sales outstanding (DSO) – it measures the average number of days it takes for a company to collect payment for its sales after the invoice has been issued.

- Days sales of inventory (DSI) – it shows the number of days it takes for a company to sell its inventory.

- Labor productivity index – it is calculated by dividing the company’s total sales revenue by the average number of employees over a given period of time.

How to conduct a ratio analysis?

Let’s explore how to use a ratio analysis to assess your company’s financial health.

Compare the actual state with the plan

Creating a comprehensive business plan and financial forecast before starting a company is crucial for tracking progress, assessing goal attainment, and identifying areas for improvement.

Review your company’s balance sheet

The balance sheet will give you an overview of your company’s financial position, including its assets and liabilities.

Take a look the income statement

The income statement can help you determine if your company’s expenses are exceeding its budget and whether sales goals are being achieved.

Analyze the cash flow statement

A cash flow statement is a financial statement that provides information about the cash inflows and outflows of a company during a specific period of time.

Calculate financial ratios

Use the collected data to calculate specific financial ratios. This will help you determine the current state of your business, identify any issues, and make necessary changes. Additionally, consider external factors and competition when conducting the analysis. In the example, we will show you how to calculate and interpret just a few of the indicators mentioned above.

Debt to assets ratio

The higher the ratio, the higher the proportion of a company’s assets that are financed with debt. A ratio of 1 indicates that the company’s total debt is equal to its total assets, which means that the company is 100% financed by debt.

The higher the ratio, the higher the proportion of a company’s assets that are financed with debt. A ratio of 1 indicates that the company’s total debt is equal to its total assets, which means that the company is 100% financed by debt.

Long-term debt to equity ratio

Equity can be calculated as the difference between a company’s assets and liabilities. The closer the value of a company’s long-term debt to equity ratio is to 1, the higher the proportion of debt to equity, which indicates higher indebtedness of the company.

Current ratio

A current ratio of 2 or higher indicates that a company may have excess liquidity. While having excess liquidity may seem favorable, it is not always the case since the available funds should be invested in profitable opportunities to generate higher returns. A ratio below 1.2 indicates a bad financial situation and there’s a risk of bankruptcy.

Return on sales (ROS)

A return on sales ratio of 0.25 means that for every dollar spent by the company, it generated 0.25 dollars (25 cents) in operating profit. If the return on sales ratio is lower, the company needs to achieve higher sales volume to maintain profitability.

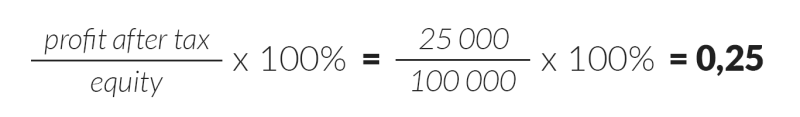

Return on equity (ROE)

The higher the value of this ratio, the better it is for the company. Therefore, financial data from earlier periods should be used as a benchmark. In this case, there is no range that we should aim for. We may also receive negative values, which indicates incurred losses.

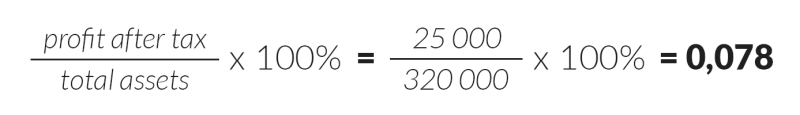

Return on assets (ROA)

A higher value of this ratio indicates a more favorable situation for the company. As previously mentioned, it’s essential to take into account previous financial statements to get a better perspective.

Summary

A ratio analysis is one of the ways to assess a company’s financial situation. To carry it out successfully, it is necessary to thoroughly prepare its financial statements and calculate certain values. What’s more, it’s essential to properly interpret the obtained data as the success of a company often depends on the decisions made based on this information. To get an objective assessment, it’s also helpful to keep in mind the general economic situation and other external factors that may affect the health of your company, and to compare the results with those of competitive entities.

Read also: All about business process mapping. Can it be used in ecommerce?

If you like our content, join our busy bees community on Facebook, Twitter, LinkedIn, Instagram, YouTube, Pinterest, TikTok.

Author: Andy Nichols

A problem solver with 5 different degrees and endless reserves of motivation. This makes him a perfect Business Owner & Manager. When searching for employees and partners, openness and curiosity of the world are qualities he values the most.