Invoices are the documents that are used in all companies. The report E-Invoicing/E-billing. Digitalization and Automation claims that more than a billion invoices are being issued each day. Most of them are VAT invoices, but many of them are invoices for a receipt. Do you know what is the difference between those two types of invoices? You may not be aware that there is a distinction between them and issue a bad type of invoice for your customer. In such a scenario, your mistake can result in further tax consequences for your client.

It is worth finding out, who is the receiver of the VAT invoice and who should get an invoice for a receipt. Read the article to find out more.

VAT invoice and invoice for a receipt – table of contents:

- Invoice for a receipt – who can get one?

- VAT invoice – who needs one?

- What are the consequences of the bad type of invoice?

- How the VAT is calculated?

- Elements of invoices

- Summary

Invoice for a receipt – who can get one?

An invoice for a receipt can be issued to the final purchaser, or the final consumer of the product or the service, who is using the purchased goods for his personal use. It means that goods or services will not be sold to another entity. Usually, the final purchaser is a private person, who is not running a business. Such individuals buy for their personal use – they don’t have to provide their tax identification number during the purchase process, and they are not entitled to a tax credit – they cannot deduct VAT. In their case the invoice has only one aim, it is a form of a request to pay for a delivered product or service.

VAT invoice – who needs one?

A VAT invoice is required by every person, who plans to re-sell the purchased products. This concerns the semi-finished products and raw materials, that are used for the production of other products for sale. Similarly, this type of invoice is required for services that are necessary when running a business for example advertising services, Facebook business account maintenance, copywriting, or other marketing activities. Most contemporary companies need such services, but to be able to deduct the tax, they need VAT invoices from their contractors.

Besides all other information, that has to be inserted on the invoice for a receipt, the most important element of a VAT invoice is an accurate specification of the tax value. The correctly issued document should contain the tax identification number of the contractor as well.

What are the consequences of the bad type of invoice?

Issuing the bad type of invoice, from the point of view of the issuer has no huge consequences. After all, the invoice proves the fact of selling, and both types of invoices fulfill this function.

From the perspective of the client, the difference between the two types of invoices is huge. If the client purchased the product for future re-sell and received an invoice for a receipt he won’t be able to deduct VAT tax after the re-sales.

On what factors should you base your decision on the type of invoice for your client? There is one simple way to establish the right type of invoice efficiently. Each client with a national identification number should receive VAT invoices, while individuals, who don’t have the number should get invoices for a receipt.

How the VAT is calculated?

VAT (value-added tax) known in some countries under the acronym of GST (goods and services tax) is a tax, that due to its construction is neutral to all companies. It means that from the perspective of business VAT is economically not visible. Although the companies pay the VAT tax to the tax office, the real taxpayers are the final consumers. The value that is being paid by the clients, who pay for goods or services, contains the VAT tax, which cannot be deducted.

Sellers, who pay VAT tax, must add the VAT tax value to each product and service they sell. In their case, the value of VAT payable to the tax office appears on the invoices and receipts. The entrepreneur who possesses a VAT invoice for products (services) purchased may deduct the tax calculated (output tax) from the tax due (input tax). The difference between the two has to be paid to the tax office.

Elements of invoices

Both types of invoices contain the same information related to the customer and seller, types and price of products or services, methods and dates of payment, and date of issuing and sales. The VAT invoice, due to its purpose, contains an accurate specification of the VAT tax that was paid for each of the products or services.

Although the invoice for a receipt can contain the value of the tax – in the summary of the transaction for example – it is not a sufficient specification of the VAT tax that can be presented to the tax office, because each position on the invoice has to contain the exact value of the tax and the correct VAT rate.

Summary

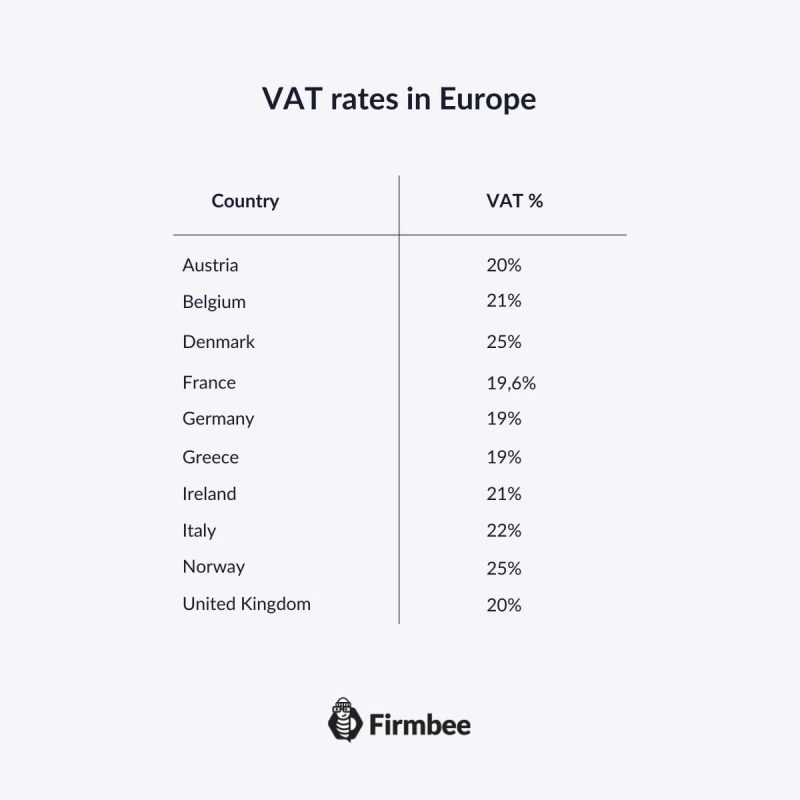

You can cope with the VAT tax easily using Free Invoicing App. The app will show the necessary hints and suggestions about VAT rates that are used in the country of your business operation. All you have to do is to choose the right rate and the application will calculate the tax automatically and will present its value next to the right product and in the summary of the invoice.

Read also: When should you issue an invoice?

If you like our content, join our busy bees community on Facebook, Twitter, LinkedIn, Instagram, YouTube, Pinterest.

Author: Andy Nichols

A problem solver with 5 different degrees and endless reserves of motivation. This makes him a perfect Business Owner & Manager. When searching for employees and partners, openness and curiosity of the world are qualities he values the most.